The European Digital Identity Wallet Consortium (EWC) has released a white paper outlining how the European Digital Identity Wallet (EUDIW) could be used for payments. This initiative aims to give EU citizens a secure way to authenticate and complete transaction using their digital identity.

The EUDI Wallet is set to play a key role in payments, allowing users to authenticate transactions, confirm age at checkout, and provide proof of income or verified account details.

Introduced under the amended eIDAS regulation in May 2024, EU Member States must ensure citizens have access to it by 2026, with public and private entities required to accept it by 2027.

The wallet will store various attestations, including identity details, and payment data, while supporting financial services in AML and Strong Customer Authentication requirements. However, integrating the EUDI Wallet into the complex existing payment ecosystem requires addressing challenges like security, reliability, fraud prevention, and regulatory compliance.

This project is part of the EU’s larger effort to provide citizens with a secure, universal digital identity. The EUDI Wallet will not only support payments but also allow people to store and share digital documents like mobile driving licenses and education credentials while maintaining privacy and control over personal data.

The Key Points emanating from the White Paper are as follows:

- Biometric Authorisation: The EUDI Wallet will support fingerprint and facial recognition in order to enhance security and user convenience.

- Seamless Payments: Users can link their wallet to payment accounts or cards, using cryptographic proofs to securely authorize transaction – aligns with the existing standards like 3-D Secure.

- The wallet will store various credentials, including payment details, proof of income and age verification, making it useful for online shopping, in-store purchases and regulatory compliance (AML checks).

- The white paper acknowledges hurdles like liability concerns, risk monitoring, and operational scalability. The consortium aims to resolve these issues before launching the wallet EU-wide by 2026.

The Three Pillars of a European Digital Identity

1. Strengthen the national eIDs system under eIDAS

Enhance the effectiveness and efficiency of the mutual recognition of national electronic identification (eID) schemes by introducing optional certification mechanisms. Additionally, establish a mandatory requirement for Member States to notify their respective eID schemes to ensure uniform compliance and interoperability across jurisdictions.

2. User Controlled Digital Identity – Personal Wallet

Develop a secure and trusted European digital wallet application for mobile devices, enabling users to store and manage their identity data, attributes, and credentials. This wallet will be based on common standards, ensuring interoperability and security while granting users full control over their personal information.

3. Regulating Private sector providing identity-linked services

Enable private providers to offer digital identity-linked services by issuing qualified attestations of attributes to the digital wallet. These attestations will comply with enhanced regulations governing qualified trust services, ensuring alignment with national eID frameworks and reinforcing security, trust, and interoperability across the EU.

Leveraging Proven Models: BankID and itsme’s impact on the EUDI Wallet

Sweden's BankID and Belgium's itsme have thrived due to their user-friendly interfaces and integration into everyday life. BankID, launched in 2003, became a trusted solution in Sweden by offering easy authentication for banking, government, and private services through a simple, intuitive app. Similarly, itsme in Belgium gained popularity for its ease of use in signing documents and logging into services, backed by secure multi-factor authentication.

Both systems succeeded by focusing on simplicity, security, and frequent usage, offering valuable lessons for the EUDI Wallet.

The EUDI Wallet could benefit from adopting the successful models of BankID and itsme by focusing on simple, intuitive interfaces that make authentication and identity verification effortless for users. By ensuring broad integration into daily services and applications, the wallet could become indispensable, encouraging frequent usage. Additionally, balancing strong security with ease of use—through features like multi-factor authentication and seamless workflows—would make the EUDI Wallet both secure and convenient. These practices would enhance its adoption and reliability, ensuring it becomes a trusted tool across Europe.

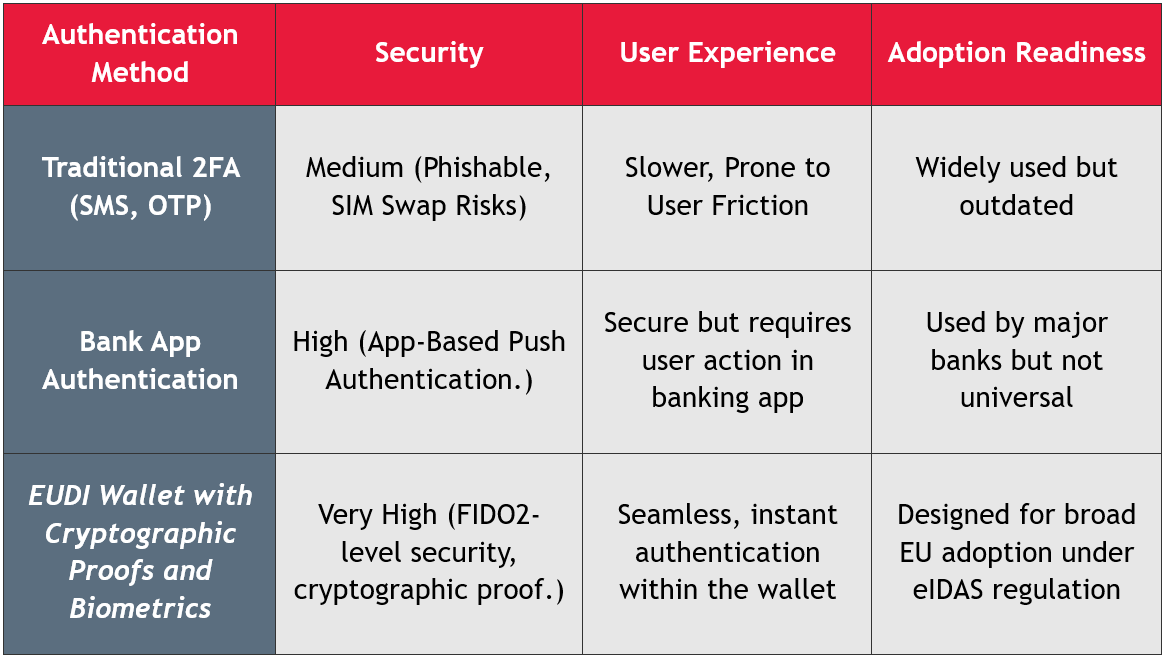

EUDI Wallet as an Alternative Strong Customer Authentication (SCA) Method

A key innovation discussed in the White paper is the wallet’s role as a payment wallet attestation, offering an alternative method for SCA. Instead of requiring each PSP to manage authentication independently. The wallet itself can generate cryptographic proofs that banks and financial institutions can trust. Users would first link their EUDI Wallet to a payment account or card during resignation, created a trusted payment wallet attestation that PSPs and merchants can use for transaction verification. When making a payment, the wallet generates a unique cryptographic proof that confirms the user’s identity and intent, ensuring a secure transaction. Biometric authentication, such as fingerprint or facial recognition, further enhances security and convenience by eliminating the need for passwords or one-time codes. Instead of requiring PSPs to manage multiple authentication processes, banks retain control over final authentication decisions, relying on the wallet’s cryptographic proofs to verify transactions while reducing operating complexity.

Potential Challenges & Considerations of the EUDI Wallet

- The White Paper acknowledges that liability frameworks for authentication need to be clarified. Determining who is responsible in case of fraud or identity misuse (wallet provider, bank or PSP) remains a key challenge.

- Banks and PSPs must establish trust agreements with wallet providers. Ensuring the wallet remains interoperable across multiple PSPs and payment networks is crucial for widespread adoption.

- Consumers must feel confident in using biometric-based authentication for payments. Public awareness campaigns and education on security benefits will be essential.

The Benefits to all the Stakeholders of the Payment Ecosystem

- Consumers – The EUDI Wallet offers users a secure, convenient and seamless way to manage their digital identity and payments across Europe. It reduces friction in daily activities like online shopping, government services and identity verification.

- Businesses – Streamlines customer interactions, reducing the need for traditional authentication methods such as passwords or physical ID checks. This improves efficiency, reduces fraud risk and lowers operational costs associated with identity verification.

- Government and Public Sector – Governments benefit from the EUDI wallet by ensuring secure standardized digital identity verification across member states. Enables the delivery of efficient e-government services – improves access to public services and ensures compliance with data privacy regulations – like GDPR. Facilitates also cross-border identification for citizen, creating a more unified digital infrastructure within the EU.

- Financial Institutions – Banks and payment service providers benefit from the increased security and simplified authentication processes enabled by the EUDI wallet. Offers the financial institutions the opportunity to expand their digital offerings while ensuring compliance with EU regulations.

- Technology Providers – benefits from supporting an interoperable, pan-European digital identity solution. This fosters new opportunities for innovation, such as integrating biometric authentication or enhancing blockchain technology for secure transactions, further boosting their marker presence.

Written by: Kyle Buhagiar, Junior Lawyer